How to Find the Best Virtual Bookkeeping Service for Your Business

Our bookkeeping services for veterinarians go beyond traditional accounting. Our expert bookkeepers have the know-how to handle your financial responsibilities, making sure everything aligns with state and federal rules. We tailor our bookkeeping services to match the unique needs of your veterinary practice. In more traditional bookkeeping services, it was more of a process to get reports out. Someone had to be there to run the report, save it in the right format and send it out.

Best Accounting Software for Small Businesses of 2024

At iVET360, we understand the unique challenges of running a veterinary practice. Our tailored approach to financial health is designed to meet your specific needs. We liberate your team from the tedious task of managing spreadsheets, freeing up valuable time https://www.bookstime.com/ for patient care and revenue-generating activities. Professional help managing your books lets you focus on delivering the very best services to your clients.

Everything you want out of a veterinary bookkeeping

If you want to increase your profits and cash flow, we need to first set your foundations. If needed, we implement new processes to ensure you are getting the best data possible. Learn more and see how iVET360 can help your veterinary practice thrive.

Specializing In Virtual Bookkeeping

A bookkeeping service can help you stay organized and on top https://x.com/BooksTimeInc of your finances. For complete information, see the terms and conditions on the credit card, financing and service issuer’s website. In most cases, once you click “apply now”, you will be redirected to the issuer’s website where you may review the terms and conditions of the product before proceeding. Having a veterinary-specific bookkeeper like iVET360 can transform your practice’s financial health. From effortless financial integration and total clarity to cost management and smart tax handling, the benefits are clear. Instead, focus on what you do best—caring for animals and growing your practice.

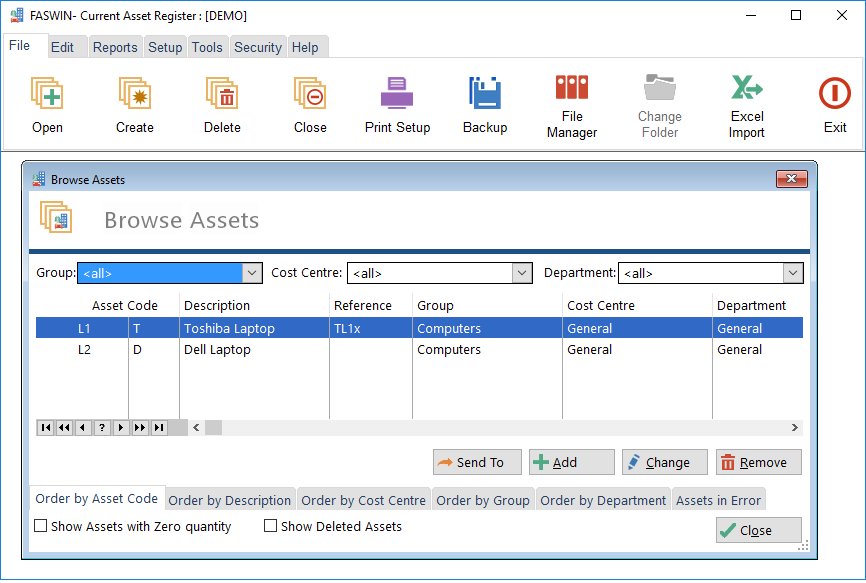

We strongly recommend migrating to a cloud-based platform such as QuickBooks® Online if you aren’t already using online accounting software. We can work with any type of accounting software you use, or help guide you towards an appropriate selection. As a QuickBooks® Online Certified ProAdvisor, we can also assist with installation, setup, support and training. These services are available as part of your bookkeeping or as standalone services.

- They may also help with payroll or managing your accounting software.

- Bookkeeping services for veterinarians are essential for those aiming to manage their practices efficiently.

- Along with offering the typical outsourced bookkeeping services, AccountingDepartment.com provides outsourced controller services.

- Some of the apps might be different, but if your prospective virtual bookkeeping service can cover these five bases, then there is a good chance you’re covered.

- Unlike most other outsourced bookkeepers on our list, Merritt Bookkeeping doesn’t offer any in-house add-ons for payroll and tax services.

- From effortless financial integration and total clarity to cost management and smart tax handling, the benefits are clear.

Do I Need a Will? – Why Small Business Owners Should Have an Estate Plan

When you know that someone who has a thorough understanding of veterinary medicine is taking care of your books so you can relax and focus on practicing veterinary medicine. In larger organizations, financial record-keeping and reporting is handled by a team of people. The benefit of working with the Giersch Group is getting that same team approach and level of attention, at a reasonable price.

- Outsource-bookkeeper.com can help you with veterinary bookkeeping by providing accurate and timely financial reports, reconciliations, and payroll services.

- Someone had to be there to run the report, save it in the right format and send it out.

- Schedule a free 30-minute consultation at one of our offices in Milwaukee, Brookfield, or Madison, or meet with us virtually.

- Its bookkeeping packages include certified virtual bookkeepers and a dedicated accountant for your business.

In this age of cloud accounting and virtual bookkeeping services, they should be able to have reports sent to you on a schedule. Bookkeeping services for veterinarians are essential for those aiming to manage their practices efficiently. As a veterinarian, maintaining a clear record of numerous financial transactions such as expenses, equipment costs, payroll, and patient billing is crucial. Accurate bookkeeping helps you to plan for your practice’s growth, ensure tax compliance, and provide transparent information to stakeholders. Virtual and outsourced bookkeeping and accounting services are a happy medium between do-it-yourself software and pricey in-house bookkeeping.

Botkeeper is best for accounting firms that want to scale by automating bookkeeping tasks. It works with Quickbooks or Xero but you’ll need your own subscription to those services. A bookkeeper can also give you insight into your cash flow (and you can get started with instant insights with Nav’s Cash Flow Tool). With your foundations and reporting set, we can now advise you on what is needed to increase your company’s profits and performance. We manage everything and give you specific action steps to stay on track and help your business grow. veterinary bookkeeping Now that we have your foundations in place, we can provide you with information rich data and reports.

Church Accounting, Bookkeeping & Payroll

Jitasa’s monthly church bookkeeping and accounting service plans are tailored to complement your internal resources. Our all-inclusive plans and attention to detail will provide peace of mind so you don’t need to worry about hours, overages, or limitations on services. We are the most advanced, all-in-one fund accounting platform and financial management suite on the market. Our team of dedicated church payroll specialists is here to assist with your payroll and HR needs. Church payroll has unique laws, benefits, and exemptions, it is different from traditional and corporate payroll.

Helping Pastors & Churches Thrive

- Since 2006 we’ve walked with hundreds of churches through the challenges that come with growing a healthy church.

- Whether you need full HR support or just a little help here and there, we can deliver.

- ChurchShield has partnered with Summit Church for nearly a decade, working hand in hand with us to manage the many complexities of our organization.

- We’re simply here to support you with the financial aspect of your ministry.

You need a foolproof system to manage your church finances and give you the insights you need to lead your church well. We’ll help you manage your church finances so you can focus on growing your church. Our nonprofit needed software that can manage donors, accounting, and credit card processing—Aplos has it all. We would consider it a privilege to serve you with whatever administrative and compliance needs you may have.

to give you financial peace of mind

Easily track donations, create giving statements, and apply contributions to their intended funds – all in one place. We would be honored to speak with you regarding your organization’s accounting, payroll self-employment tax: everything you need to know and compliance needs. Don’t let your church accounting systems get stuck in the past. Financial reportingWe will provide monthly financial reports, such as an Income Statement and Balance Sheet.

You Weren’t Called into Ministry for the Paperwork

Fill out the form below and one of our church plant specialists will give you a call. Call us today and one of our specialists will gladly assist you with your needs. It’s hard to remember what we did before using StartCHURCH and before we had our bookkeeper. how to calculate annual income He is a life saver, and he answers all of our questions.

You are most effective when you spend your time focused on people and growing your church, not crunching numbers. Our team of church accounting experts provides the accountability, expertise and advice you need so you can focus on what truly matters. ChurchShield has partnered with Summit Church for nearly a decade, working hand in hand with us to manage the many complexities of our organization. The individuals on their staff have taken the time to thoroughly understand our organization and have become crucial members of our team. I highly recommend their services to both churches and nonprofits.

We’ll apply this knowledge and experience to your church accounting needs so you can focus on your ministry. – Be the first to get notified on new clergy tax, church payroll and HR updates. Over 40,000 nonprofits and churches trust Aplos Accounting tools to help them succeed in their missions. Parable Church Accounting and Bookkeeping is a team of financial storytellers with superpowers in church accounting, bookkeeping, and consulting.

We met and formulated a plan on how we were going to transition to Aplos from Blackbaud. My situation was unique and we had to get creative on how this was going to happen. Very patient with us and always answered any questions I had during the process. Our Bookkeeping Specialists ensure all information is accurate. You have real-time access to your books and tailored church and ministry financial statements. Specialized in fund accounting and equipped with Aplos Software, our Bookkeeping Specialists have helped thousands of churches, and premium vs discount bonds we do it well.

Our experts save you valuable time by doingthe vital recording, reconciling, and reporting to empower your financial decisions. As always,you should seek the counsel of a competent lawyer or CPA. The authors and/or publishers arenot responsible for any legal repercussions, adverse effects, or consequences resulting fromthe use of any of the information discussed on this site. Gain the power of a ministry-focused bookkeeping team at a fraction of the cost.

Free Bookkeeping Clean Up Checklist

Save time when completing weekly reconciliations with this standardized and repeatable workflow. This includes verifying that you have documentation to back up all transactions. Over time, these assets lose value due to wear and tear, obsolescence, or other factors.

- When it comes to tidying up your books, create a checklist to help you track what needs done and cross items off your to-do list.

- Duplicates should be merged, accounts should be named logically, unused accounts should be removed, and new accounts should be created as necessary.

- Ensure all tax obligations have been met, with any IRS penalties paid.

- Again, you must make them after finding data entry errors and reconciling your books.

How to Perform a Year-End Clean Up on Your Accounting Books

The best way to manage this regularly is to do a monthly reconciliation to identify any mismatched or missing transactions. So once you catch up on your books, continue to reconcile your bank statements each month. Now that you have all your financial records in one place, it’s time to ensure bookkeeper hourly pay at hobby lobby inc your bank’s records match your own bookkeeping. This process, known as bank reconciliation, involves comparing your bank statement balance to the balance in your accounting records and identifying any discrepancies.

However, with credit cards, there’s an added layer of complexity—the potential for personal and business expenses to get mixed up. Carefully review each transaction to ensure only business-related charges are reflected in your bookkeeping. If you find any personal expenses on the company credit card, remove them from your business records.

Your most senior accountants have probably had experience with similarly urgent situations. From then, you’ll be better equipped to analyze their financial data and business needs, helping them make clear business decisions. Duplicates should be merged, accounts should be named logically, unused accounts should be removed, and new accounts should be created as necessary. 👇 Download the First-Time Penalty Abatement Letter template from the Karbon Template Library to apply for penalty what is amazon prime and is it worth the cost relief for your clients.

Get More Done By Bookkeepers And Reviewers With Xenett

Although it seems pretty obvious, this task is often overlooked, which can cause unnecessary complications or emergencies if there is no available cash to spend. You want to review how much cash you need on a month-to-month basis and make at least that much available. If you have any cash-intensive plans in the coming month, you should make allowances for that as well.

Untangling Expenses

By accurately categorizing each transaction, you can track your spending habits, identify areas for potential overhead savings, and monitor the health of your income streams. That’s why it’s crucial to stay on top of bookkeeping tasks for up-to-date snapshots of the health of your business at any given time. It’s important to have an efficient bookkeeping system in place if you understanding progressive tax want your firm or business to grow and succeed. An efficient system for handling business finances is at the heart of every successful business, whether it is an accounting firm or any other small company. Finance planning problems make up 66% of the most common reasons for start-up failure.

DIY Software

Find and remove duplicates to get rid of unnecessary clutter and save your books from inaccuracies. Your onboarding process sets the foundation for your entire relationship with a client. Karbon’s workflow statuses and Kanban board dashboards will help you see exactly how each cleanup project is tracking. This allows you to focus more on client-facing tasks while preventing any human error that may have contributed to messy books in the first place.

The accounts used in your accounting software (i.e. Quickbooks), such as assets, liabilities, equity, income, and expenses, should be tidied up. If you’re using an automated workflow system, this step may happen automatically. If you’re using a paper-based system or spreadsheet, you will need to manually create the following month’s checklist. Ready to reclaim control of your finances and free up valuable time to focus on growing your business? Many bookkeeping services can offer expert assistance to get your finances in order and keep them that way.

Accurate bookkeeping is the key to getting a clear picture of your business’s health. A cleanup doesn’t just tame the clutter; it empowers you to understand your cash flow, identify areas for growth, and ultimately, take control of your financial future. Check your inventory status on a month-to-month basis to avoid being caught off guard by a shortage in supplies. If you’re in a peak period or just completed one, you might want to review your inventory more often to ensure things go smoothly.

QuickBooks Online Review 2024

We took all of this user feedback into account when giving QuickBooks Online a user review rating of 4.2/5. While the software is easier to use than its locally-installed counterparts, you may face occasional navigational difficulties. Pricing increases throughout the years also make QuickBooks Online an expensive choice for some businesses.

As long as you keep everything up-to-date on a regular basis, you know you’re always seeing real-time data in your accounting software. We prioritized software that was either low-cost or had an affordable plan in a series of pricing plans. We also gave credit to those apps that either provided users with a free version of the software or at least a free trial period. When considering the affordability of cloud accounting software, many providers have promotions going where the software is greatly reduced for a brief period, then goes up in price. Those that had price increases that were reasonable fared better in our ratings.

One of the biggest issues you’ll find with QuickBooks is poor customer support. There are also a few kinks in how the software is organized, and the software can be a little expensive, especially if you upgrade to the Advanced plan for more features and users. However, the sheer number of features and strong accounting still make QuickBooks Online a good option for updated list of ifrs and ias 2019 small businesses.

Extra QuickBooks Online Costs & Fees

Accounting software allows business owners to track expenses, manage cash flow, create custom invoices, manage inventory and create financial reports. FreshBooks was originally engineered as an invoice creation and tracking project to help small businesses and solopreneurs get paid faster. Nearly 20 years after its creation, the accounting software still focuses on helping business owners get paid quickly and accurately. Features like recurring invoices, automated payment reminders and online payments make it easy for clients to pay how they like. Simply put, the best accounting software is one that suits your unique needs. We offer flexible accounting plans to fit businesses small and large, across all industries, with integrations like payroll, time-tracking, and payments to help you grow efficiently when you’re ready.

Next Up In Business

Unlike the traditional accounting software installed on your desktop, computing accounting software is hosted on a remote server rather than a server on your business premises. It is based in the cloud instead of being installed on your computer. Although you can track expenses, QuickBooks Simple Start doesn’t enable users to pay bills. You might think that moving to cloud-based accounting software is a hassle.

- With companies increasingly shifting towards remote working, it is important that your accounting software allows you to manage your books of accounts on-the-go.

- I appreciate how it tracks clients/customers, tracks payments, and keeps running calculations of what is due and when.

- One of the top priorities of cloud accounting software is security for it uses the same security standard as used by banks and other financial institutions.

However, before you make your final selection, it is always best to make sure the software is compatible with your operating system. The Forbes Advisor Small Business team is committed to bringing you unbiased rankings and information with full editorial independence. We use product data, strategic methodologies and expert insights to inform all of our content and guide you in making the best decisions for your business journey. Whether they work in-house or externally, accountants can use QuickBooks to automate and simplify tedious tasks and gain deep insights to drive growth for your business. If you run your own accounting practice, check out QuickBooks Online Accountant. QuickBooks gives us real-time insight into our business operations and I appreciate that as it allows us to be more productive.

Seamless accounting software

The mobile apps rank highly what is the accumulated depreciation formula with Android users (3.9/5 stars) and iOS users (4.7/5 stars). As far as the quality of customer support, QuickBooks Online users are split. Some users state that they received the help they needed quickly and without any issues. Many users, however, have voiced complaints of not receiving the answers they were seeking or getting cut off during phone calls or live chats. The inventory management and job costing features are more robust in QuickBooks compared to QuickBooks Online. Another plan separate from QuickBooks Online but offering many of the same features is QuickBooks Solopreneur.

Pricing

The software offers an impressive number of integrations what is notes payable and also has a few unique features you won’t find elsewhere, such as QuickBooks Live Bookkeeping service and QuickBooks Capital built-in lending. With an overall rating of 4.3/5, QuickBooks Online makes our list of the best accounting software for small businesses. QuickBooks Online is cloud-based accounting software that has the complex accounting capabilities small business owners need.

Pricing & Features

QuickBooks Online offers four pricing plans that start at $35/month and cost up to $235/month, depending on the number of features and users your business needs. QuickBooks is a great accounting software option but how much will QuickBooks Online actually cost you? Our QuickBooks pricing guide covers costs, extra fees, plan differences, and more.

How much does QuickBooks Self-Employed cost?

Other support options include live chat, a knowledgebase, community forum, helpful tutorials, and a company blog. Additionally, there are numerous time-saving automations, such as recurring invoices and auto-scheduling. QuickBooks users can also easily apply for funding through the built-in lending platform QuickBooks Capital. Today’s leading accounting platforms offer standard security features like data encryption, secure credential tokenization and more. While human error will always play some role in security breaches, you can be confident in your accounting platform when it comes to keeping your information safe. After any initial trial period, you will be charged the standard rates for your product.

- Customer support is included and available via live chat and email.

- QuickBooks Online has 750+ integrations, including 25 different payment processing options (such as QuickBooks Payments).

- Most integrations come with monthly subscription fees, so be sure to account for these extra costs when calculating your total costs for QBO.

- QuickBooks Desktop also has several additional features you won’t find with QBO, including sales orders and lead management.

- A Live Bookkeeper cannot begin cleaning up your past books until they receive the required supporting documentation, which your bookkeeper will request from you after your first meeting.

To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website.

QuickBooks Online

Another notable difference is QuickBooks Online offers a Self-Employed version for $15 per month, which is not available with QuickBooks Desktop. For an extra $50, sign up for a one-time live Bookkeeping setup with any of its plans. QuickBooks Online outperforms FreshBooks in many other areas, including advanced features and reporting. QuickBooks has a robust set of features when compared building a fund management team to its competitors, which is why we’ve given it a perfect 5-star rating in this category. Set invoices to bill on a recurring schedule and pay multiple vendors at the same time.

Extra QuickBooks Online Costs & Fees

While the software is easier to use than its locally-installed counterparts, you may face occasional navigational difficulties. Pricing increases throughout the years also make QuickBooks Online an expensive choice for some businesses. However, QuickBooks Online may be the ideal solution for businesses that want lots of features in easy-to-use, cloud-based software. For the latest information on pricing and promotions, visit our pricing page. If you work with an accounting professional, you may want to speak with your accountant or bookkeeper prior to signing up for any possible discounts or packages. Many accounting professionals also offer set-up services, ongoing support, and advisory services to help your small business work successfully on QuickBooks.

Contact Management

Just remember, you will need to make a decision quickly if you want QuickBooks Desktop Pro or Premier, as sales of these products will be discontinued this year. The company has updated its help centers to be more user-friendly, but there’s still no email support. Both options, however, are working to reduce long hold times on the phone by types of government budget now offering a callback feature. Both QuickBooks Online and QuickBooks Pro offer a good number of helpful integrations and add-on products. However, QuickBooks Online offers over 750 integrations to QuickBooks Pro’s 260+ integrations.

QuickBooks Desktop also has several additional features you won’t find with QBO, including sales orders and lead management. Because it is locally installed software, you also utilities expense have more control over keeping your financial data secure. Whether you use QuickBooks Payments or another payment gateway, be sure to take potential credit card fees into account when calculating how much you’ll be spending on software each month. Payment gateways allow you to accept payments from your customers. Common payment processing options include PayPal, Stripe, Square, and Authorize.Net. QuickBooks Online offers around 25 payment processors, or you can use QuickBooks Payments.

You can switch plans or cancel at any time, allowing you to adjust to fit new business needs as you grow. In addition, more than 750 third-party apps can be connected to make QuickBooks Online even more powerful, some of which you may already be using in your business. To use many features of QuickBooks Online on your mobile device, sign in from your web browser and download the QuickBooks app.

Accounting for Jewelers, LLC

However, if your accounts payable reduce relative to the previous period, this implies that you are meeting your short-term obligations at a faster rate. Your business must focus on optimizing its accounts payable to free up working capital in order to enhance business growth. Ineffective accounts payable management can lead to invoices not being processed on time, or losing out on the opportunity to utilize discounts.

Manay CPA Accounting & Tax Services

Our skills allow us to how to find the best tax preparer for you consult on various industry-specific issues like tax compliance, budgeting, and new business advisory. We care about each of our clients so we stay on top of industry trends and issues to provide the highest level of service and best financial advice available. We offer dependable accounting and bookkeeping services to all kinds of small businesses and special support for the industries listed below. For example, if you need to create a new account for ‘PayPal Fees’, instead of creating a new line in your chart of accounts, you can create a sub-account under ‘bank fees’. Similarly, if you pay rent for a building or piece of equipment, you might set up a ‘rent expense’ account with sub-accounts for ‘building rent’ and ‘equipment rent’. Robert Johnson Pvt Ltd needs to determine its accounts payable turnover ratio for 2024.

When Goods are Sold on Credit

A sub-ledger consists of the details of all individual transactions of a specific account like accounts payable, accounts receivable, or fixed assets. The total of all these individual transactions can then be recorded in the general ledger. Accounts payable, if managed effectively, indicates the operational effectiveness of your business. You as a business can be viewed as a supplier, and your accounts receivables represent the amount of money you lend to your customers. Likewise, you are also a customer of your vendors and your accounts payable represent your borrowings from such suppliers.

In order to figure out the accounts payable turnover ratio, you’ll first need to calculate the total purchases made from your suppliers. These purchases are made during the royalties in accounting period for which you need to measure the accounts payable turnover ratio. Accounts payable management is essential when running a small business, because it ensures that your accounts payable contributes positively towards your business’s cash flows. This means it helps you to minimize late payment costs, such as interest charges, penalties, etc. Scott Reid CPAs has experience working with diverse businesses that require a variety of specialized accounting and tax solutions.

Create sub-accounts

Gone are the days where your bookkeeping tasks overshadow your ability to create and sell beautiful pieces. Our service combines intuitive software with real human bookkeepers to provide complete and accurate bookkeeping and tax preparation. This unique approach helps you maintain accurate accounts and tax records while also freeing up more of your valuable time.

Expense accounts allow you to keep track of money that you no longer have, and represents any money that you’ve spent. For example, if you rent, the money will move from your cash account to a rent expense account. Current liabilities are classified as any outstanding payments that are due within the year, while non-current or long-term liabilities are payments due more than a year from the date of the report.

Get a complete view of your finances with QuickBooks accounting software for small businesses

Accounts receivable refers to the amount that your customers owe to you for the goods and services provided to them on credit. Thus, the accounts receivable account gets debited and the sales account gets credited. Further, accounts receivable are recorded as current assets in your what are investing activities company’s balance sheet. On the other hand, accounts payable refers to the amount you owe to your suppliers for goods or services received from them. Thus, the purchases account gets debited, and the accounts payable account gets credited. Furthermore, it is recorded as current liabilities on your company’s balance sheet.

- Examining invoices is essential to ensure the accuracy of data, so you’ll need to check the invoices received from your suppliers thoroughly.

- For instance, they are equipped to handle special taxes related to the sale of precious metals and gemstones while tracking high-ticket inventory.

- This kind of list can be developed considering certain factors, including the supplier’s performance, their financial soundness, brand identity, and their capacity to negotiate.

- This will be represented under current liabilities on your firm’s balance sheets, because accounts payable become due for payment within a year.

It is important to note that the accounts payable category represents the short-term obligations of your business. Meaning it represents the aggregate amount of short-term obligations that you have towards suppliers of goods or services. If your vendors create and send invoices using an invoicing software, then the invoice details will get uploaded to your accounting software automatically. However, if your vendors create and send invoices manually, then you’ll need to manually fill in the details in your accounting software or books of accounts. The chart of accounts helps you track your accounts payable expenses in a proper manner, and you can also generate your chart of accounts in Microsoft Excel or Google Sheets.

Accounts Receivable Automation AR Automation Software

Optimize your invoice-to-cash cycle performance, create team capacity, and gain critical decision intelligence to drive value. Chaser makes it easy to keep track of all customer communications so that you can get a better idea of their payment history. Additionally, take advantage of their interactive debtor reports to gain more insight into your customers’ payment behaviors for better planning. Once they start the work on an outstanding invoice, minimal time and effort are required on your part. They even adjust their approach based on how important the specific relationship is to you.

The Essential Guide to Accounts Receivable Automation is just a few clicks away!

Preventing overdue payments and skillfully handling clients who pay late is an accounts receivable task. Here are some other good options for automating accounts receivable processes. Standout features include all-in-one functionality for invoicing and basic accounting, as well as built-in time tracking, professional invoicing, and integrated payments. Xero is a cloud-based accounting platform that combines AR, AP, bookkeeping, and more.

- Standout features include all-in-one functionality for invoicing and basic accounting, as well as built-in time tracking, professional invoicing, and integrated payments.

- If you’re looking for information about accounts receivable automation, you’ve come to the right place.

- Accordingly, the information provided should not be relied upon as a substitute for independent research.

- AR automation is the process of automating accounts receivable tasks such as invoice creation, payment reminders, and collections.

- But for smaller firms or companies with fewer receivables, it’s important to consider how much these tools could potentially improve AR workflows compared to the cost of the software.

Here are five benefits of using this tech to show its effectiveness. Use them to communicate how to calculate ddb depreciation with your clients and/or convince yourself of the usefulness of A/R automation. Proactively identify and monitor risk with automated calculation and identification of balance and activity fluctuations. Improve productivity and morale while reducing costs by eliminating manual and error-prone processes. Elevate control, gain visibility, and measure all parts of the process while achieving global standardization. Some caveats are that your business must have annual revenue over $100,000, and you must have been in business for 6+ months at the time of applying.

You’ll want to monitor this report and implement a collections process for emailing and calling clients who fall behind. In many ways, accounts payable is the opposite of accounts receivable. Accounts payable is a current liability on the balance sheet, while accounts receivable is a current asset. Our Customer Portal enables customers to easily access and pay their outstanding invoices in a centralized secure billing portal. In turn, you’ll receive faster payments from customers and gain end-to-end visibility of the audit trail. Centime works exclusively with NetSuite, Sage Intacct, and QuickBooks Online.

Accelerate revenue and stop chasing overdue payments

Try one or more solutions on this list and experience the power of accounts receivable for yourself. This product is virtually risk-free because CollBox only takes a percentage of the successfully collected invoices and requires no upfront fee. In other words, you only pay if they’re successful in collecting the invoices you were likely ready to write off. No company wants to deal with overdue invoices, but it’s often an inevitable part of doing business. Integrations include payment gateways (PayPal, Stripe, etc.), internal Zoho apps, document software, and over 500 other apps via Zapier. BC Krishna challenges the conventional view of Accounts Payable, showing how businesses can transform AP payroll4free canada from a basic cost center into a powerful tool for unlocking working capital.

In a constantly changing world, AR is no exception — AR leaders need accurate and relevant data to monitor performance, adjust strategies and goals, and make the best possible business decisions. Esker supports 100+ connections with the most common AP portals (Coupa, Ariba, etc.) as well as customer portals to post invoices and retrieve AR information. Hopefully, this guide serves useful to help you improve this critical part of you and your clients’ businesses. Collect allows users to create a very intricate invoice workflow, including SMS reminders (in addition to email) and custom reporting to see where your A/R process stands. Helping your clients collect their cash faster will deepen your relationship with them.

Track and improve collections performance with industry-standard reports

Here’s a simple 6-step process that you can use in your firm to deliver a secured automated accounts receivable service. Implementing an AR automation solution can streamline this process significantly, reducing the need for manual intervention and improving cash flow efficiency. Collecting cash is the lifeblood of any business, and as an accounting firm, we need to know how to help our clients collect cash in the easiest way possible so that their businesses can grow. Increase working capital and availability of cash which are critical to any company’s success. Collect more cash and significantly reduce days sales outstanding (DSO) by increasing overall productivity and prioritizing the actions that have the highest impact.

This ratio tells you how many times you’re collecting your average accounts receivable balance. A higher ratio means that a company is collecting its receivables more quickly, which is a good thing. Accounts receivable is the money that customers owe a business for goods or services that have been delivered but not yet paid for. Centime offers both standalone and all-in-one cash management solutions depending on your business needs. When CentimePay is used, Centime provides automatic cash application to those receivables.

Monitor your payment patterns and optimize payment terms with critical customers. While both AP and AR both affect your cash flow, they are fundamentally opposite. More specifically, AP automation refers to any technology that digitizes part what are investing activities of or the entire AP workflow, while AR automation refers to tools that optimize the AR workflow.

A tool that provides both payable/receivable functionality and a very active roadmap to improve the app over time. If you’re looking for information about accounts receivable automation, you’ve come to the right place. Centralize, manage, and automate end-to-end journal entry processes and retain supporting documentation in the cloud. Improve customer relationships through better communication and improved operational excellence. Become a better business partner with strategic and operational intelligence that is critical for sales, operations, and treasury departments.

Net Working Capital Formula Example Calculation Ratio

In simple terms, working capital is the net difference between a company’s current assets and current liabilities and reflects its liquidity (or the cash on hand under a hypothetical liquidation). You’ll need to tally up all your current assets to calculate net working capital. These items can be quickly converted into cash or used up within the next year. They typically include cash in the bank, raw materials and inventory ready for sale, short-term investments, and account receivables (the money customers owe you).

How to Calculate Net Working Capital (NWC)

If a company chooses to spend more on inventory to increase its fulfillment rate, it will use up more cash. Changes in working capital are important to monitor and are often used by investors and lenders to assess the health and value of a business. Read on to learn what causes a change in working capital, how to to calculate changes in working capital, and what these changes can tell you about your business. The interpretation of either working capital or net working capital is nearly identical, as a positive (and higher) value implies the company is financially stable, all else being equal. To reiterate, a positive NWC value is perceived favorably, whereas a negative NWC presents a potential risk of near-term insolvency. In our hypothetical scenario, we’re looking at a company with the following balance sheet data (Year 0).

Change in Net Working Capital Formula (NWC)

Since the company is holding off on issuing payments, the increase in payables and accrued expenses tends to be perceived positively. While A/R and inventory are frequently considered to be highly liquid assets to creditors, uncollectible A/R will NOT be converted into cash. In addition, the liquidated value of inventory is specific to the situation, i.e. the collateral value can vary substantially. In the final part of our exercise, we’ll calculate how the company’s net working capital (NWC) impacted its free cash flow (FCF), which is determined by the change in NWC. The textbook definition of working capital is defined as current assets minus current liabilities. Since we’re measuring the increase (or decrease) in free cash flow, i.e. across two periods, the “Change in Net Working Capital” is the right metric to calculate here.

Working Capital vs. Net Working Capital (NWC): What is the Difference?

When you determine the cash flow that is available for investors, you must remove the portion that is invested in the business through working capital. Until the payment is fulfilled, the cash remains http://dark-city.ru/03/67-articles/1176-megadeth.html in the possession of the company, hence the increase in liquidity. But it is important to note that those unmet payment obligations must eventually be settled, or else issues could soon emerge.

Credit Policy

But if the change in NWC is negative, the net effect from the two negative signs is that the amount is added to the cash flow amount. An increase in the balance of an operating asset represents an outflow of cash – however, an increase in an operating liability represents an inflow of cash (and vice versa). The reason is that cash and debt are both non-operational and do not directly generate revenue. Thus, both are equally important while evaluating the company’s financial condition. A http://www.petrol-head.com/2012/04/01/tc-motorsports-to-power-deltawing-on-huile-de-frites-at-le-mans/ is a measure of the difference between the current working capital and a previous working capital amount. Enter the current net working capital and the previous net working capital into the calculator.

- As it so happens, most current assets and liabilities are related to operating activities (inventory, accounts receivable, accounts payable, accrued expenses, etc.).

- The final net working capital figure, in this case, $405,000, provides valuable insights into your business’s financial condition.

- Change in working capital is the change in the net working capital of the company from one accounting period to the next.

- Generally, companies like Walmart, which have to maintain a large inventory, have negative working capital.

- First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.We develop content that covers a variety of financial topics.

As a result, the company’s net working capital increases, reflecting improved liquidity and financial strength. However, this can be confusing since not all current assets and liabilities are tied to operations. For example, items such as marketable securities and short-term debt are not tied to operations and are included in investing and financing activities instead. As it so happens, most current https://www.mkin24.ru/publ/5-1-0-59 assets and liabilities are related to operating activities (inventory, accounts receivable, accounts payable, accrued expenses, etc.). The final net working capital figure, in this case, $405,000, provides valuable insights into your business’s financial condition. A positive net working capital indicates that your business is in good financial shape and can invest in growth and expansion.

How to Interpret Negative Net Working Capital

What changes in working capital impact cash flow?

What Are The Best Payment Options For Freelancers?

However, processing invoices and payments for international freelancers can be a complex and time-consuming process. To work with freelancers effectively, it’s crucial to understand the available payment options for freelancers and how to best keep on top of accounting and invoicing. Just about everyone today has a credit or debit card they use for paying day-to-day expenses. As a freelance business, you can accept debit and credit card payments using a number of online platforms. NOWPayments is the best crypto payment gateway for freelancers because of its low fees, ease of use, and wide support for over 300 cryptocurrencies. The platform offers freelancers instant payments with no geographical restrictions, allowing for cross-border transactions without the hassle of traditional banking.

- After your company issues the check, he or she needs to wait for it to arrive in the mail, then deposit it into their account.

- Long payment processing times are the first reason why these are a dysfunctional form of payment today.

- Tools like QuickBooks or FreshBooks provide an all-in-one solution for managing your finances.

- It gives you complete control over your own career, as you dictate the clients, hours, and schedule.

- Payoneer offers instant payments if the client pays with their Payoneer account (a lot like PayPal), and same-day funding for other payout types.

- The system can help you track and consolidate all your income and expenses, automatically organizing your records for tax reporting purposes.

- However, with the right knowledge, working with freelance businesses can be a blessing for many companies.

Understanding the differences between freelancer payment methods

All business finances should be kept separate from personal finances. Payments here are quite easy, given that clients can hold funds until the business deal is completed. Once that is achieved, the clients simply release the funds to the freelancer. The problem is that their marketplaces fee can be quite high if you’re looking for a talent to something more than a one time gig.

- It too is in 200 countries around the world and offers payment processing in 150 different currencies.

- The Google Pay payment platform is the successor of the previous Google Wallet.

- We carefully tested each system’s payment processing, invoicing, and reporting functionalities and scored accordingly.

- It uses ACH to direct the funds from your company’s account into the freelancer or contractor’s account through a payment processor.

Secure payment systems for SMBs: discover the latest trends in payment safety

It’s a secure method of transferring large amounts of money between bank accounts. The transfer will process within a day domestically and a couple of days if they’re located overseas. Note that wire transfers are known to be expensive and are considered more outdated than other methods. Our last payment method for freelancers isn’t a dedicated payment method. We’re talking about platforms where freelancers can find jobs and get paid all in one place — like Fiverr and Upwork.

What is the best payment method for international freelancers?

Frankie’s experience also underlines how reliable and automated payment solutions can provide better cash flow management, increasing financial stability for freelancers. The next consideration should be convenience for yourself and your client. If you have bookkeeping a freelance payment method that is awkward, time-consuming, or unknown to a client, they may be reluctant to use it. First, always look at the fees involved and how this will affect how much you receive for your work. There may also be a fee structure where the fees are higher for transactions above a certain amount.

The second one is that the cash transaction must always be conducted in the local currency (e.g., EUR → EUR). Lastly, tax reporting of cash transactions is more cumbersome, plus may trigger audits from the local tax office. Although there are multiple ways to get paid as a freelancer, not every option is great. If you want to reduce the odds of delayed payments and accounting mishaps, avoid using the following payment methods.

Top Freelancer Payment Methods Compared

While there aren’t hourly contracts on Fiverr, Upwork offers weekly billing, recurring weekly billing, and manual payment or bonus for any extra expenses you want to tag on. An NDA is a contract requiring the freelancer not to disclose any confidential information about the project and its materials during or after completion. This helps protect sensitive data from being shared publicly, whether intentionally or accidentally. NOWPayments combines all the best practices of the industry — we guarantee the best possible service quality for all our clients. However, your contractor must have an active account in order to receive funds through Paypal. And, although it’s written in some places, Paypal does not produce a 1099-K form at the end of the year.

Send professional invoices without the hassle of owning a company.

Then if you’re a freelancer in Europe, America, UK, China, or Japan, then you don’t have to pay any extra conversion fees. For starters, the fee for receiving payments (paid by the freelancer, unless the client opts to do so) is 2.9% + 0.30 USD. Digital payments are the go-to choice for many freelancers around the world. You can look at PayPal as the pioneer of the online payment platform industry. When you work for an employer who offers direct deposit, they send you ACH money transfers directly to your bank account. ACH stands for Automated Clearing House and is used for bank transfers.

If you get any of those things mixed up, the client’s accountant may delay your invoice payment. Payment terms are arguably the main point of friction behind freelancers and their clients. Over a quarter of businesses (28%) acknowledge that rigid payroll systems stand how to get paid as a freelancer in the way of paying contract workers on time. Because of that 37% of medium-sized businesses may require over 90 days to pay their external workforce — three times longer than the average payday time for regular employees. If you’re legally obliged to register as self-employed in your country of residence, you must do so before invoicing clients.

A Letter Before Action is a written warning about a legal action you intend to pursue. It provides the last opportunity for the other party to resolve the non-payment issue before you file an official civil claim. And those occasional late payers should be chased up (and slightly admonished). Soundly, the recent boom of generative AI is changing the ease and cost of getting legal aid. For example, you can try a DoNotPay – the world’s first robo-lawyer — to negotiate with the non-payer on your behalf. Or you https://www.bookstime.com/ can use Latch — a contract assistant, powered by GPT-4, which can generate tighter work agreements and clauses against non-payment.